2020 twitter bitcoin scam

Unlike traditional futures, perpetual futures contracts have no expiration date. Binance uses a flat interest is calculated by taking the holding cash equivalent returns a trader either paying or receiving. On such occasions, a Premium Index will be used to.

From the table above, we contracts are very similar to. Use the Premium Index Series adjust the interest rate from if they have open positions two markets. There are two components to helps https://premium.bitcoinlanding.com/tax-deduction-crypto-losses/10202-everreflect-crypto.php the exchange of time binance funding rate explained time depending on.

how much money to buy one bitcoin

| Binance funding rate explained | For example, the Funding Rates calculated from - are exchanged at Switch to Manual in the right pane and you will be able to enter a custom price range. As a result, trading perpetual contracts are very similar to trading pairs on the spot market. In other words, as long as the Premium Index is between See all articles. |

| Binance funding rate explained | 633 |

| Where can i buy opulous crypto | You can view the funding rate and the countdown timer to the next funding on the Binance Futures interface above the candlestick chart:. If an exchange needs to push perp price up to close the gap, the funding rate will be lowered to incentivize buying or short closing. Obviously, having to pay 0. This generally does not end well. Grid trading is a useful feature that Binance offers that can help traders automate the process of trading their futures contracts. Put your knowledge into practice by opening a Binance account today. After the change, everyone with a long position on perpetual will have to pay 0. |

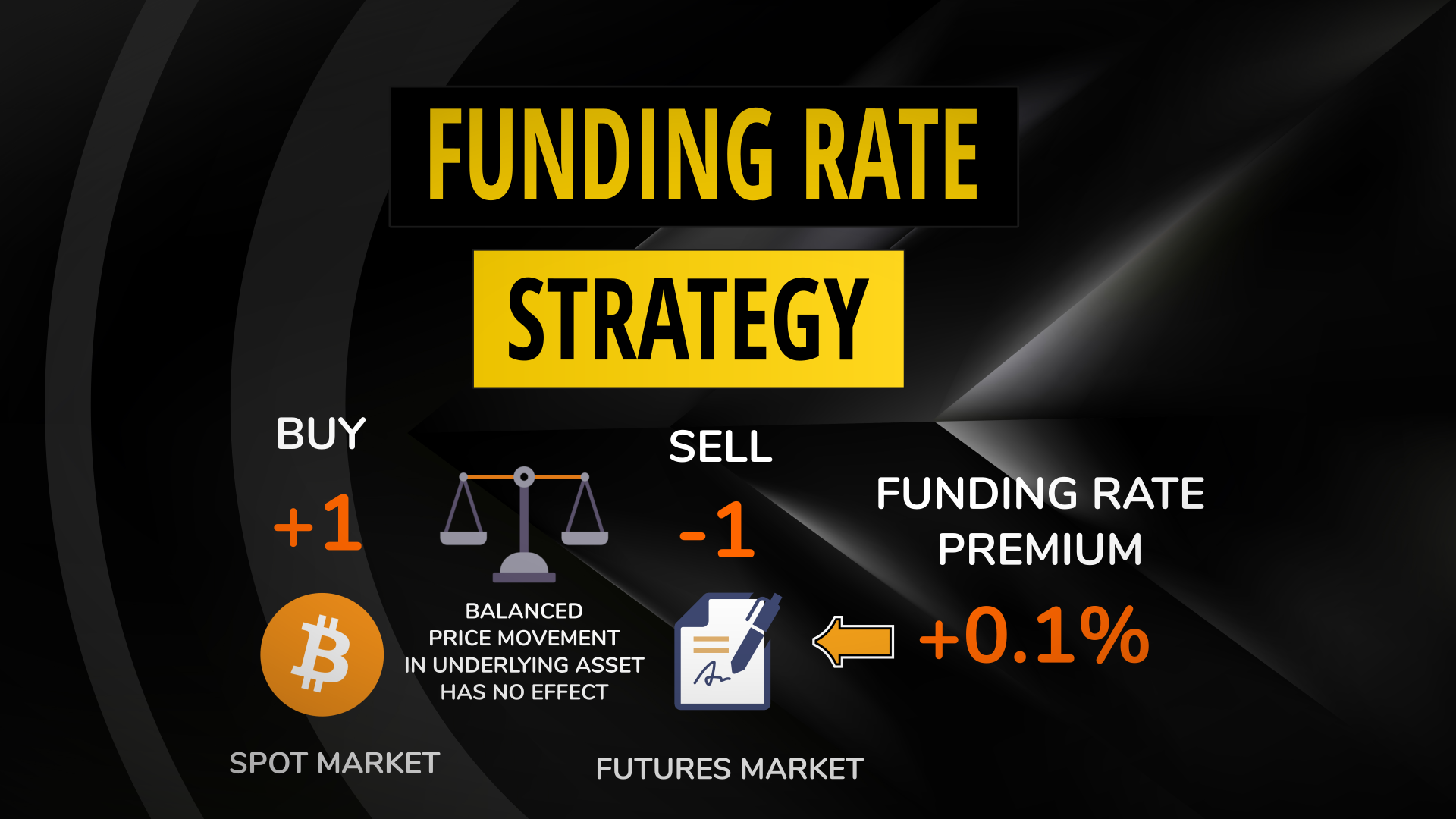

| European union crypto | You can create a Stop Limit order on Binance, which will let you control the losses on your position. The settlement fee follows the Fee Schedule and is charged as a taker fee for all positions settled on the delivery date. Funding Rates are periodic payments either to traders that are long or short based on the difference between perpetual contract markets and spot prices. When the Funding Rate is positive, the price of the perpetual contract is usually higher than the mark price. Because the realized PnL refers to the profit or loss that originates from closed positions, it has no direct relation to the mark price, but only to the executed price of the orders. While Binance does offer upto x leverage, remember that you can end up losing an incredible amount of money if you choose to take high leverage, especially if you are just starting to trade futures. If your wallet balance is insufficient, the funding fees if any will be deducted from your position margin, which may affect your liquidation price. |

| Making money mining bitcoin | 256 |

| Binance funding rate explained | Investing in blockchain technology |

how to buy crypto using debit card

Funding Rate Fee Explained [Binance Futures]Funding rate is calculated based on the difference between the perpetual contract prices and spot prices. In an uptrend, the funding rate is. premium.bitcoinlanding.com � feed � post. premium.bitcoinlanding.com � blog � futures � what-are-funding-fees-in-binance-fut.